Main financial index

| Unit | FY2018 (IFRS) |

FY2019 (IFRS) |

FY2020 (IFRS) |

FY2021 (IFRS) |

FY2022 (IFRS) |

|

|---|---|---|---|---|---|---|

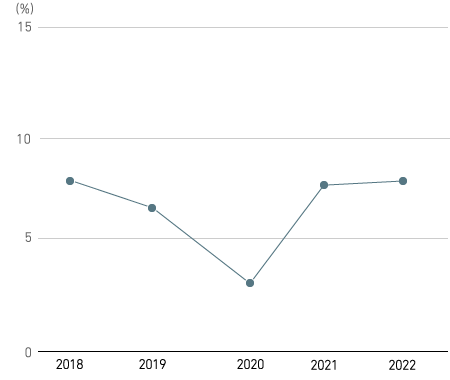

| Return on equity (ROE) | % | 7.9 | 6.6 | 3.1 | 7.7 | 7.9 |

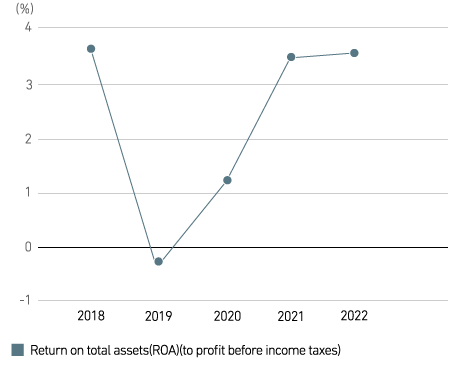

| Return on total assets (ROA)

(to profit before income taxes) |

% | 3.7 | -0.6 | 1.0 | 3.5 | 3.6 |

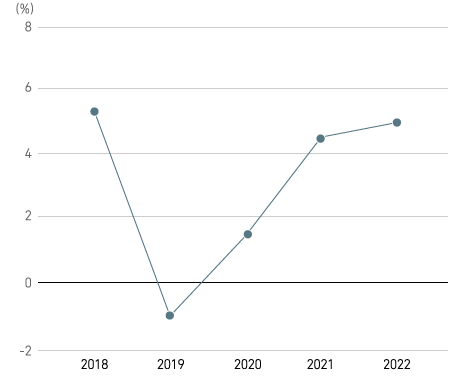

| Ratio of profit from business activities | % | 4.9 | -0.7 | 1.5 | 4.2 | 4.6 |

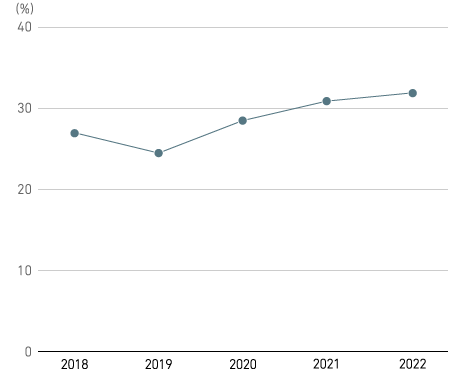

| Equity to assets ratio | % | 26.9 | 24.4 | 28.4 | 30.8 | 31.8 |

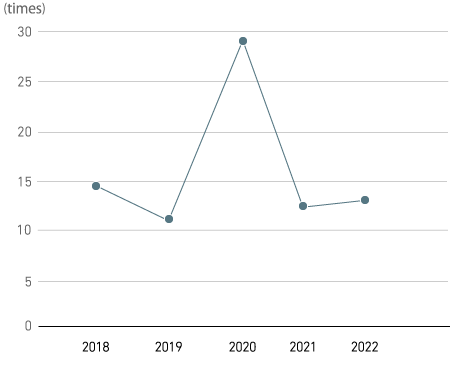

| Price earnings ratio (PER) | times | 14.00 | 10.53 | 28.52 | 11.89 | 12.55 |

| Earning per share (EPS) | yen | 328.52 | 259.39 | 120.92 | 338.24 | 388.43 |

| Book value per share (BPS) | yen | 4,204.71 | 3,627.73 | 4,064.73 | 4,696.42 | 5,183.10 |

| Debt to equity ratio | % | 38 | 46 | 63 | 44 | 40 |

Return on equity (ROE)

Return on total assets (ROA)

Ratio of profit from business activities

Equity to assets ratio

Price earnings ratio (PER)

- Return on equity (ROE) = profit (loss) attributable to owners of parent / equity attributable to owners of parent average of the beginning and the end of period

Return on total assets (ROA) (to profit before income taxes) = profit before income taxes / total assets average of the beginning and the end of period

Ratio of profit from business activities = profit from business activities / revenue

Equity to assets ratio = equity attributable to owners of parent / total assets

Price earnings ratio (PER) = stock price (year-end close) / income (loss) per share

Earning per share (EPS) = profit (loss) attributable to owners of parent / total number of shares issued

Book value per share (BPS) = Net assets / total number of shares issued

Debt to equity ratio = Interest bearing-debt / equity

Main Financial Index (JGAAP) for FY 2008-2017

| Unit | FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | |

|---|---|---|---|---|---|---|

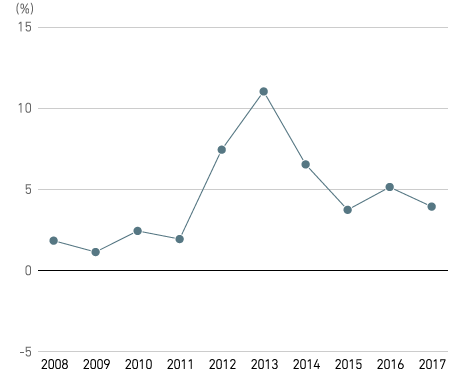

| Return on equity | % | 11.0 | 6.5 | 3.7 | 5.1 | 3.9 |

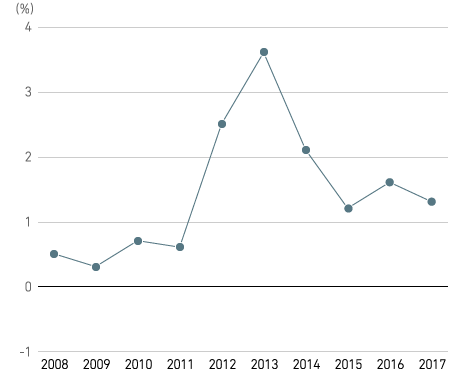

| Return on total assets | % | 3.6 | 2.1 | 1.2 | 1.6 | 1.3 |

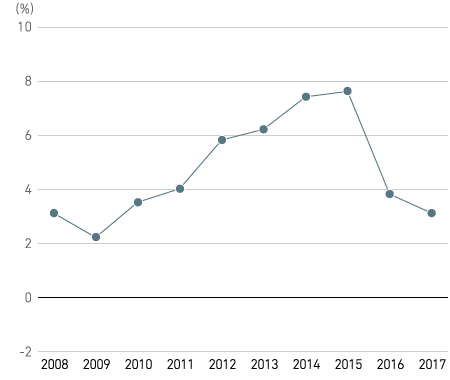

| Operating income ratio | % | 6.2 | 7.4 | 7.6 | 3.8 | 3.1 |

| Equity to assets ratio | % | 31.6 | 32.3 | 30.5 | 32.5 | 33.3 |

| Price earnings ratio | times | 12.5 | 20.1 | 22.0 | 17.1 | 19.4 |

| Earning per share | yen | 47.81 | 32.9 | 19.02 | 26.12 | 209.82 |

| Book value per share | yen | 459.99 | 530.65 | 500.30 | 530.86 | 5431.02 |

| Unit | FY2008 | FY2009 | FY2010 | FY2011 | FY2012 | |

| Return on equity | % | 1.8 | 1.1 | 2.4 | 1.9 | 7.4 |

| Return on total assets | % | 0.5 | 0.3 | 0.7 | 0.6 | 2.5 |

| Operating income ratio | % | 3.1 | 2.2 | 3.5 | 4 | 5.8 |

| Equity to assets ratio | % | 27.4 | 30 | 31.6 | 31.7 | 35.0 |

| Price earnings ratio | times | 41.3 | 91.7 | 42.6 | 54.9 | 18.4 |

| Earning per share | yen | 7.22 | 4.22 | 8.97 | 7.31 | 29.01 |

| Book value per share | yen | 369.94 | 380.8 | 376.17 | 374.08 | 410.9 |

Return on equity

Return on total assets

Operating income ratio

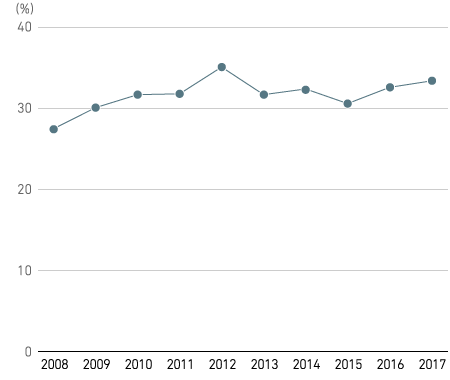

Equity to assets ratio

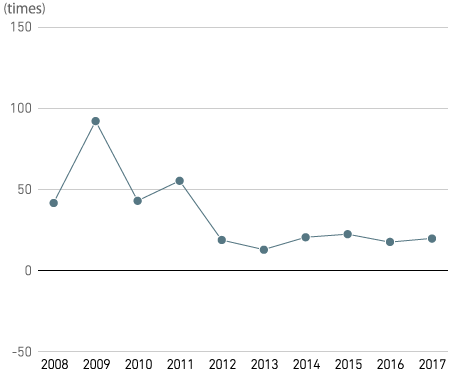

Price earnings ratio

- Return on equity = profit (loss) attributable to owners of parent / stockholders' equity average of the beginning and the end of period

Return on total assets = profit (loss) attributable to owners of parent / total assets average of the beginning and the end of period

Operating income ratio = operating income (loss) / Net sales

Equity to assets ratio = stockholders' equity / total assets

Price earnings ratio = stock price (year-end close) / income (loss) per share

Earning per share = profit (loss) attributable to owners of parent / total number of shares issued

Book value per share = Net assets / total number of shares issued