Shareholder Return Policy

MHI Group's basic shareholder return policy is to provide returns mainly through dividends, considering the balance between business growth and financial stability.

As a way of providing a progressive dividend in line with profit growth while achieving highly predictable and stable payments, we target a DOE (Dividend on Equity ratio: Dividends paid ÷ Shareholder equity excluding OCI(Note)) of 4% or higher.

Through this policy, we aim to steadily increase dividends over the medium to long term.

- OCI: Other Comprehensive Income (includes foreign currency translation adjustments and other valuation adjustments)

For details, please refer to our 2024 Medium-Term Business Plan (P34).

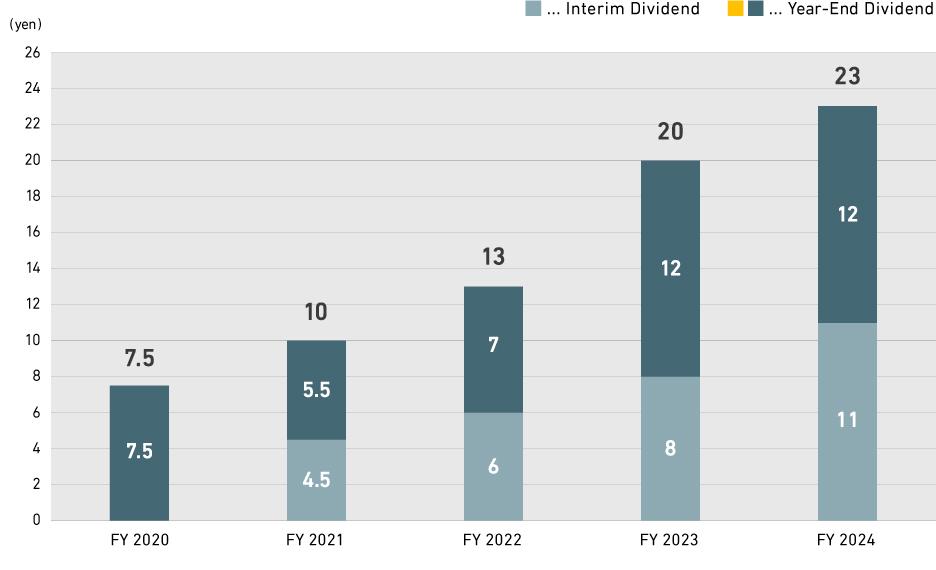

Annual Dividend per Share

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | |

|---|---|---|---|---|---|

| Interim Dividend (yen) | 0.0 | 4.5 | 6.0 | 8.0 | 11.0 |

| Year-End Dividend (yen) | 7.5 | 5.5 | 7.0 | 12.0 | 12.0 |

| Total Dividend (yen) | 7.5 | 10.0 | 13.0 | 20.0 | 23.0 |

- On April 1, 2024, MHI executed a ten-for-one stock split of its common shares. To facilitate comparison, dividends through FY2023 are shown here retroactively adjusted to reflect the stock split.

Dividends Calendar

| FY2024 Year-End Dividend | FY2025 Interim Dividend | |

|---|---|---|

| Record Date | March 31, 2025 | September 30, 2025 |

| Payment date | June 30, 2025 | Early December 2025 |